Is B2Broker Two Jumps Ahead of Its Competitors? Read Our Review

B2Broker is a global FX, CFD and cryptocurrency liquidity provider, offering technology solutions for online brokers, banks and trading venues. With a total of 5 offices in Russia, Cyprus and Hong-Kong, the company provides comprehensive solutions to more than 150 businesses worldwide. This review will focus on a couple of aspects of the business of B2Broker. As always, we will objectively present to you the offered products and services with their strengths and weaknesses.

Being the main aspect of the B2Broker’s business, the institutional liquidity provision service provides raw prices directly from the market. Through a single margin account clients can trade more than 800 instruments of 7 different asset classes: stock CFD-s of US, European, Asian and Russian origin; cryptocurrencies; FX pairs; ETFs; indices; metals; and commodities. Brokers can take advantage of a relatively high institutional leverage: 1:100 for Forex products and 1:5 for cryptos.

B2Broker aggregates and distributes liquidity through various systems, including: One Zero, Prime XM, AMTS, FIX API, Bridge MT4, Gateway MT5, WL MT4/MT5 and Tools4Brokers Bridge. The liquidity pool is already integrated and fully compatible with: MetaTrader 4 and 5; cTrader; xStation; DX Trade; B2Trader; etc.

Liking this review so far? Check Our Services to see how we can help You!

The liquidity pool has some advantages which need to be considered. To begin with, a margin account can be funded both in fiat (EUR and USD) and in crypto (BTC, ETH and XRP). Second, a client gains direct access to deep institutional liquidity pools, which guarantee really tight spreads, no requotes and fast execution as a direct result of the lack of a dealing desk. Third, the Tier-1 hosting (Equinix NY4/LD4) ensures low latency connection and a rather fast execution. Finally, one has the chance to go both long and short on each of the offered tradable instruments.

Of course, B2Broker has disadvantages which need to be assessed carefully. The first and most notable one is related to pricing. The minimal monthly fee starts from $2,000 and the minimal deposit requirement is $20,000. Depending on the pricing option, a one time bridge technology, gateway and API fee could also be charged.

Second, depending on the employees’ workload, the onboarding procedure could take much longer than the normal time for the industry. Last but not least, with its less than 1,000 trading instruments, B2Broker is still far behind big players like Interactive Brokers, Charles Shwab and so on.

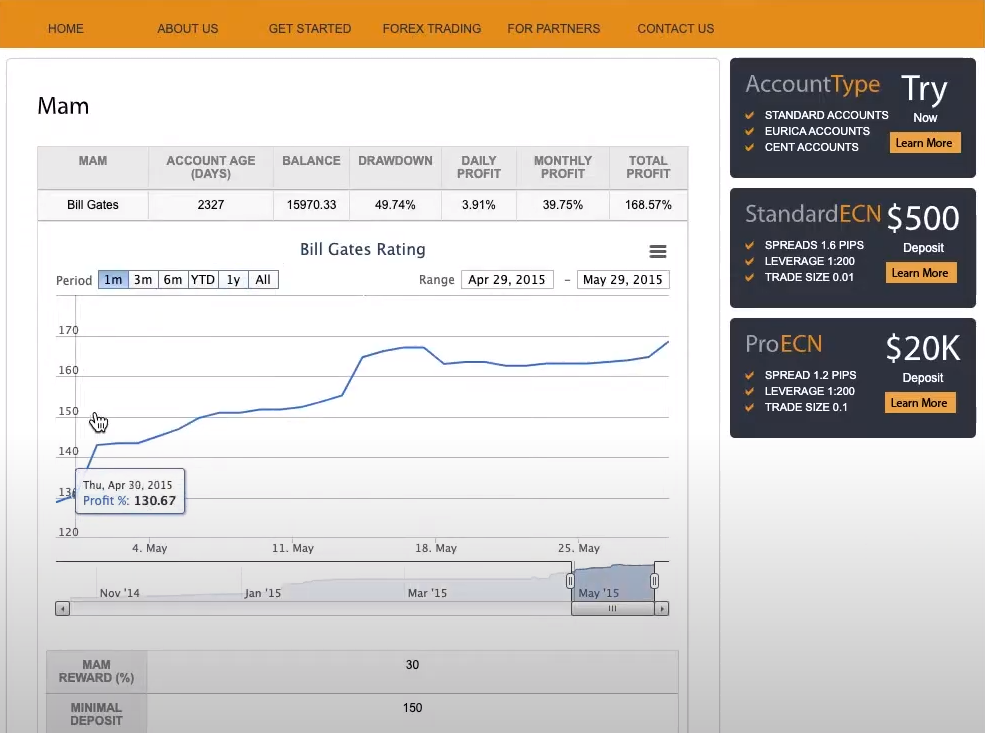

The company’s investment platform is suitable for those looking for money management products. There are 3 types of accounts for masters and investors: social trading, PAMM and MAM. Social trading enables an investor to choose one or multiple signal providers and copy their trades automatically. The PAMM combines an entire pool of investors in a single master account. The MAM is a classic portfolio management tool. The flexibility it provides makes it a suitable choice for regulated brokers and hedge funds.

The investment platform has a mobile friendly web interface for both traders and investors. The admin panel and manager’s apps are light and relatively easy to use. There is a website widget with a leaderboard and statistics charts. One of the key functions of the software is the integrated internal risk management system for masters and investors. The platform features detailed trading statistics, while performance, volume and management fees are paid automatically. It is operational with MetaTrader only and can be easily connected with an API.

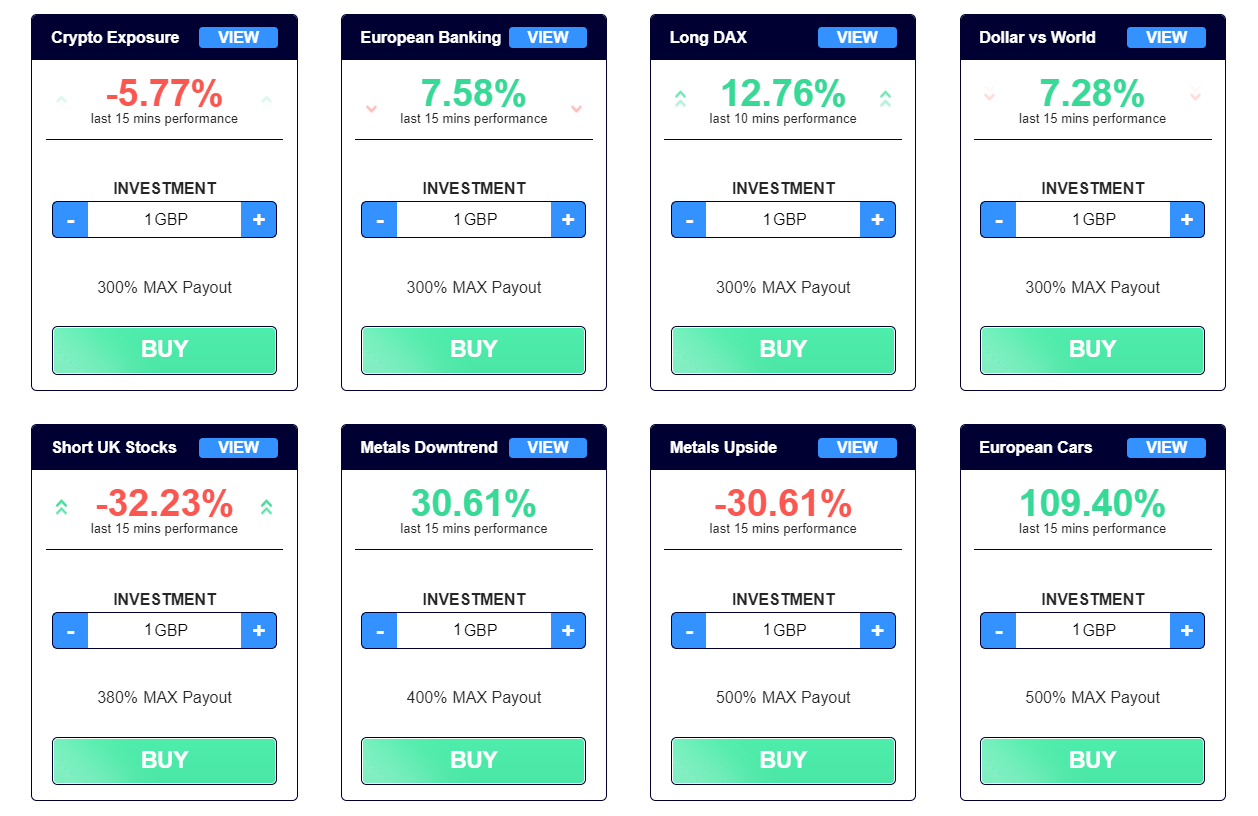

The company has a fully web-based and customizable platform to meet the big demand for trading on margin. Users can trade in more than 800 instruments in the FX, CFD and Cryptocurrency asset classes. Accounts can be opened both in fiat and crypto as their base currency. The same applies for deposits and withdrawals.

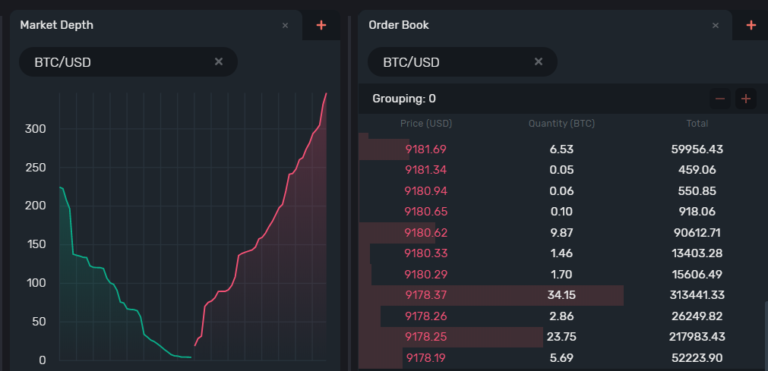

The platform’s interface is not user friendly enough, which makes operation a bit harder and more time consuming. The trading software comes together with the liquidity provided by B2Broker. In fact, one cannot take advantage only of the platform without using the company’s liquidity. This gives traders the chance to see the market depth for each of the tradable instruments. Both A-book and B-book groups are available, which makes the product suitable for both ECN/STP brokers and market makers.

The software is not rich in reports and tools for analysis, which we perceive as a weakness. So this is something that needs to be developed further. The charts B2Broker uses in its platform are a product of TradingView, a well known company in the Forex and CFD industry. Traders have hundreds of indicators for technical analysis at their disposal.

B2Broker provides high quality customer care services to its existing clients. With offices in Cyprus, Moscow and Hong-Kong, the technical support team is available on a 24/7 basis. Inquiries can be handled in seven languages by phone, chat and email. Apparently, support agents are rather experienced professionals, as they readily deal with both easier and more complex issues, while it strikes that waiting times are kept relatively short.

Security is one of the top priorities of B2Broker, and for this reason, the company has made solid efforts to guarantee its clients a secure and hack-free environment. The various measures taken to guarantee system soundness and stability include: complex data encryption; two factor authentication; additional confirmation of each transaction; multi-level data backup; and protection against network attacks.

When we recently reviewed another one of B2Broker’s products – the B2Core’s CRM, we mentioned that the main focus of this company is indeed the liquidity provision services. This company’s liquidity pool has several serious advantages, such as the ability to fund margin accounts both in fiat and crypto, the direct access to deep institutional liquidity pools and the low latency connection. But the main disadvantage as in most cases is the high cost of their service. And while the investment platform manifests B2Broker’s high professional standards, in comparison the margin trading platform is rather disappointing.

Based on the review above, on the scale from 1 to 10, our FinTechTycoon expert score is

Kenmore Design is a fintech business specializing in B2B Forex web solutions. With more than ten years of experience in the industry, the company has developed quite a few products to meet the specific needs of…

A well-established name in the financial industry, Trading Cores has focused its efforts and expertise in developing and delivering a whole range of innovative, user-friendly and easy to use trading platforms. Regular updates result in the…