A Brief Insight Into ESMA

What is ESMA?

ESMA which stands for the European Securities and Markets Authority, was conceptualized in 2009, primarily as part of recommendations from the report of the de Larosière Group. This group, which was chaired by French Central Banker Jacques de Larosière, was commissioned in 2008 by the European Commission to present a report on the future of the supervision and financial regulation in Europe, following the devastating effects of the global economic meltdown of 2008.

That event was precipitated by the collapse of the US subprime mortgage market, after several largely unsupervised assets that were based on that market were sold to investors around the world. Europe was hit hard by the effects of this crisis. The fallouts led to the commissioning of the de Larosière Group, which came up with a working document that would dictate the future of supervision and regulation of the financial markets in Europe.

ESMA was thus a creation of that document and commenced operations in 2011. ESMA took over the functions of the Committee of European Securities Regulators (CESR), leading to the dissolution of the latter.

ESMA’s mandate was clear. It was to function with greater independence that CESR, and commit itself to maintaining the integrity and stability of the EU’s financial system.

Who Controls ESMA?

ESMA is created to operate as an independent body. However, it is a creation of the European Commission and therefore answers to the agencies of the EU such as the European Commission, Economic and Monetary Affairs Committee (ECON) and European Parliament. So while the EU Commission does not interfere with ESMA’s day-to-day operations, it still requires ESMA to be accountable to it. Apart from periodic appearances by its key personnel on request, ESMA is also required to submit an Annual Report.

What is ESMA Responsible for?

Investor protection and financial market stability are the main crux of ESMA’s mandate. ESMA is also to supervise national regulatory agencies in the EU member states.

ESMA delivers on these mandates using four operating channels:

• Assessment of risks to the financial markets, financial stability and to investors.

• Direct supervision of national regulatory bodies and financial entities.

• Providing a single, unified rulebook for EU financial markets

• Promoting supervisory convergence

Risk Assessment and Market Stability

ESMA critically analyses the current market trends and reviews market events to determine the potential for risks of these to the financial markets and the investors in these markets. ESMA also analyses risk to financial stability. The essence is to detect and tackle any risks and systemic vulnerabilities before they distort or damage the market. Where certain market developments have occurred in a manner that poses threats to the stability of the financial system, ESMA has a mandate to take action to save the investors and stabilize the market. We see an example of this in ESMA’s rule changes of 2018, which among other things, mandated all EU brokers to implement negative balance protection for their clients. This was a direct consequence of the market upheaval that occurred on January 15, 2015 when the Swiss National Bank de-pegged the Swiss Franc from the Euro, causing massive slippage on accounts that had bet against the Swiss Franc. When the Swiss Franc gained nearly 30% on some pairs as a result, many traders and brokers had their stops blown away and accounts sent into negative balances. Some brokers went under and a few were saved by last minute bailout deals (such as Leucedia’s $300million rescue of FXCM at the last minute).

ESMA works with other supervisory and regulating agencies around the EU to fulfil its risk assessment mandate. Risk assessment reports from national regulators are harmonized and fed to European Systemic Risk Board (ESRB). ESMA now acts on the identified risks and implements them through its rulebook. This rulebook now forms the basis on which direct supervision of national regulatory agencies is carried out. Information is also provided to investors through periodic notices.

Supervisory Convergence

ESMA operates on the principle of supervisory convergence. This enables it to ensure that its rules are applied uniformly and consistently across all EU member states. This ensures a level playing field in all markets across all EU member states and plugs arbitrage loopholes that may be exploited from one market to another across EU borders. This function protects smaller investors in the pool.

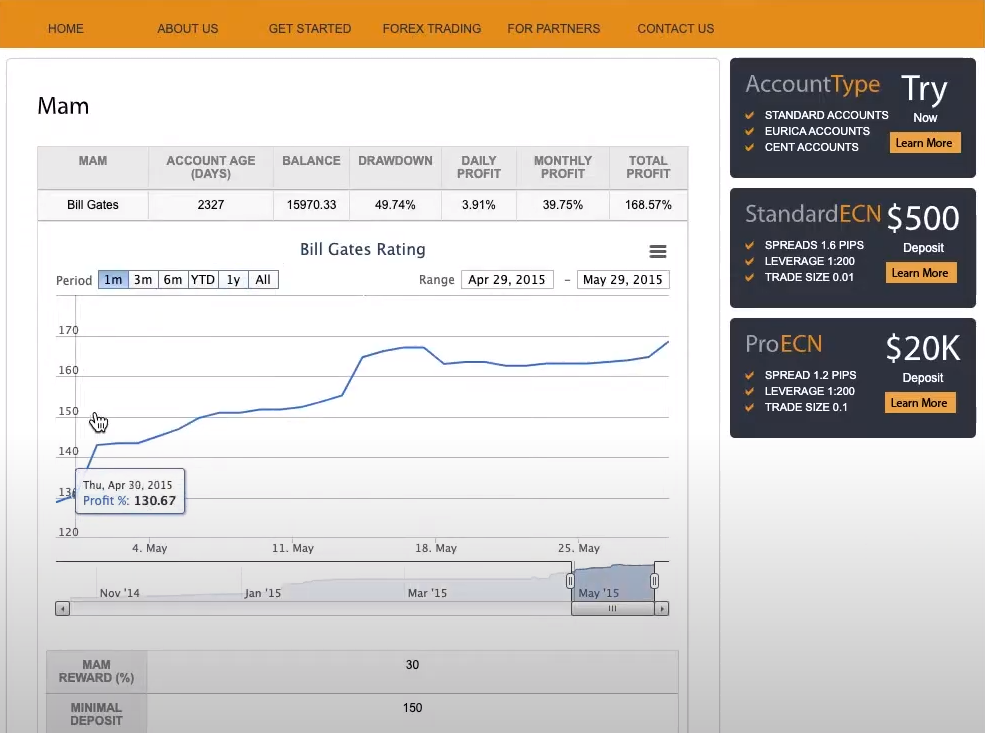

Direct Supervision of National Regulators & Specific Entities

ESMA directly supervises the national regulators of the financial markets all over Europe, and all directives issued are implemented by these bodies. There are other financial entities that fall under ESMA’s supervision. These entities, which also constitute part of the market structure in the EU, include Trade Repositories and Credit Rating Agencies.

Development of a Single Rulebook

ESMA operates a unified rulebook that is operations across all the financial markets in the EU, irrespective of the country. This is to ensure uniformity from one country to the other, and also to create a playing field which is level and transparent for everyone. This is also in the spirit of the single market that makes up the EU. This ensures that the same rules you see with a broker regulated by CySEC will be the same rules you get with a BaFIN-regulated entity.

Overview of 2018 Restrictions

The new rules regarding the trading of financial market assets in the EU took effect in 2018. They were the result of ESMA’s delivery of its four-pronged mandate to assess the risks to investors and the financial markets. As already mentioned, the market upheaval of January 15, 2015 was the factor which triggered the risk assessment that was carried out by ESMA, and which gave birth to the new rules that took effect in 2018. These rules covered margin requirements, the marketing and distribution of financial product by brokers, trading of certain assets and institution of new rules of operation to protect the so-called “unsophisticated” investors.

In a nutshell, these are some of the new rules:

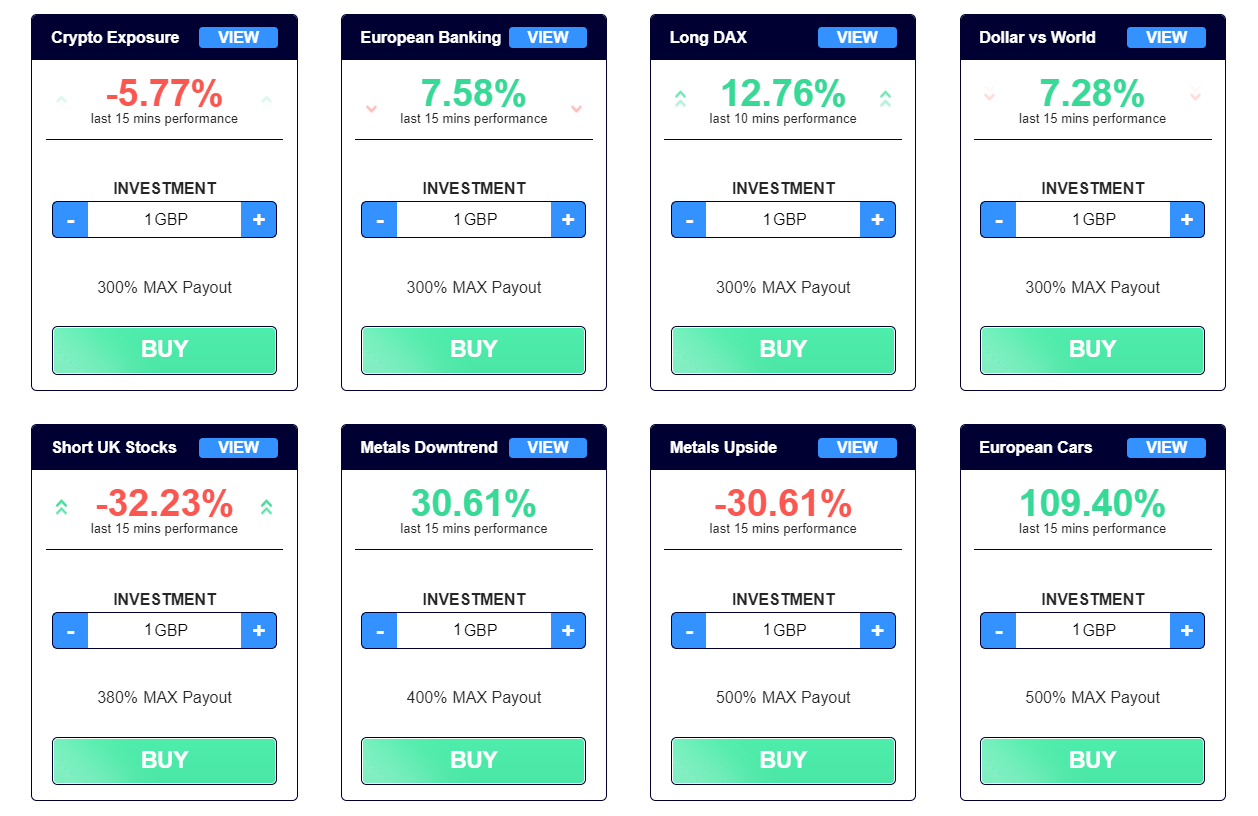

1. A ban on the marketing, distribution or sale of binary options to retail investors.

2. Restriction on the sale, marketing and distribution of Contracts for Differences (CFDs) to retail investors. Restrictions to cover limits on leverage used for trading, with leverage caps set as follows:

• 30:1 for major currency pairs;

• 20:1 for non-major currency pairs, gold and major indices;

• 10:1 for commodities other than gold and non-major equity indices;

• 5:1 for individual equities and other reference values;

• 2:1 for cryptocurrencies

3. Change of the margin close out rule on a per account basis, to be set at 50% of minimum required margin.

4. Brokers to initiate a negative balance protection scheme on a per account basis

5. Prohibition on use of bonuses or incentives by brokers

6. All brokers to issue specific risk warnings in a standardized manner on their websites, which are to include percentage of traders that lose money on the platform. All brokerages to state licensing information on the home page of their websites.

The restrictions were set to be reviewed every three months, with possibility of quarterly extensions.

2020: Amendment to the Latest Restrictions

There has been significant pushback from the trading community as well as from brokers in the EU stemming from the implementation of the new rules. Many traders who could not afford the new margin requirements have simply moved to offshore brokerages, leading to significant loss of revenue for EU brokers. As at 2020, the European Commission has initiated a public discussion aimed at reviewing MiFID II and ESMA’s mandates. On its own part, ESMA has ceased renewal of prohibitions on binary options trading as well as the restrictions on the sale, marketing and distribution of CFD products.

Brexit has also thrown up a lot of confusion on the passporting scheme which had hitherto allowed EU brokers to take up office in the UK and source clients from there. With the COVID-19 pandemic putting business activity on hold, the financial trading world still awaits clarity on some of these issues.

Kenmore Design is a fintech business specializing in B2B Forex web solutions. With more than ten years of experience in the industry, the company has developed quite a few products to meet the specific needs of…

A well-established name in the financial industry, Trading Cores has focused its efforts and expertise in developing and delivering a whole range of innovative, user-friendly and easy to use trading platforms. Regular updates result in the…